- Europäische ETFs beendeten den Monat Dezember mit einem Nettoneuvermögen von 35,0 Milliarden US-Dollar, wobei die Mittel sowohl in Aktien- als auch in Anleihen-ETFs flossen.

- Aktien-ETFs kamen auf Nettozuflüsse von 25,1 Milliarden US-Dollar, ihre Anleihen-Pendants auf 9,0 Milliarden US-Dollar.

- Vanguard UCTIS ETFs beendeten den Monat Dezember überwiegend mit Zuflüssen und wiesen ein Nettoneuvermögen von insgesamt 2,8 Milliarden US-Dollar aus.

Monatsbericht: Jährliche ETF-Kapitalzuflüsse erreichen neuen Rekord

Schlussendlich erwies sich 2025 in den meisten wichtigen Märkten und Assetklassen als gutes Jahr. Zwar sorgten Handelsspannungen kurzfristig für Volatilität und anhaltende Unsicherheit – die Anlegerstimmung konnte dieses Umfeld über das Gesamtjahr gesehen aber nicht trüben. Sowohl globale als auch US-Aktien verzeichneten starke Zugewinne und auch globale Anleihen beendeten das Jahr mit einem Plus.

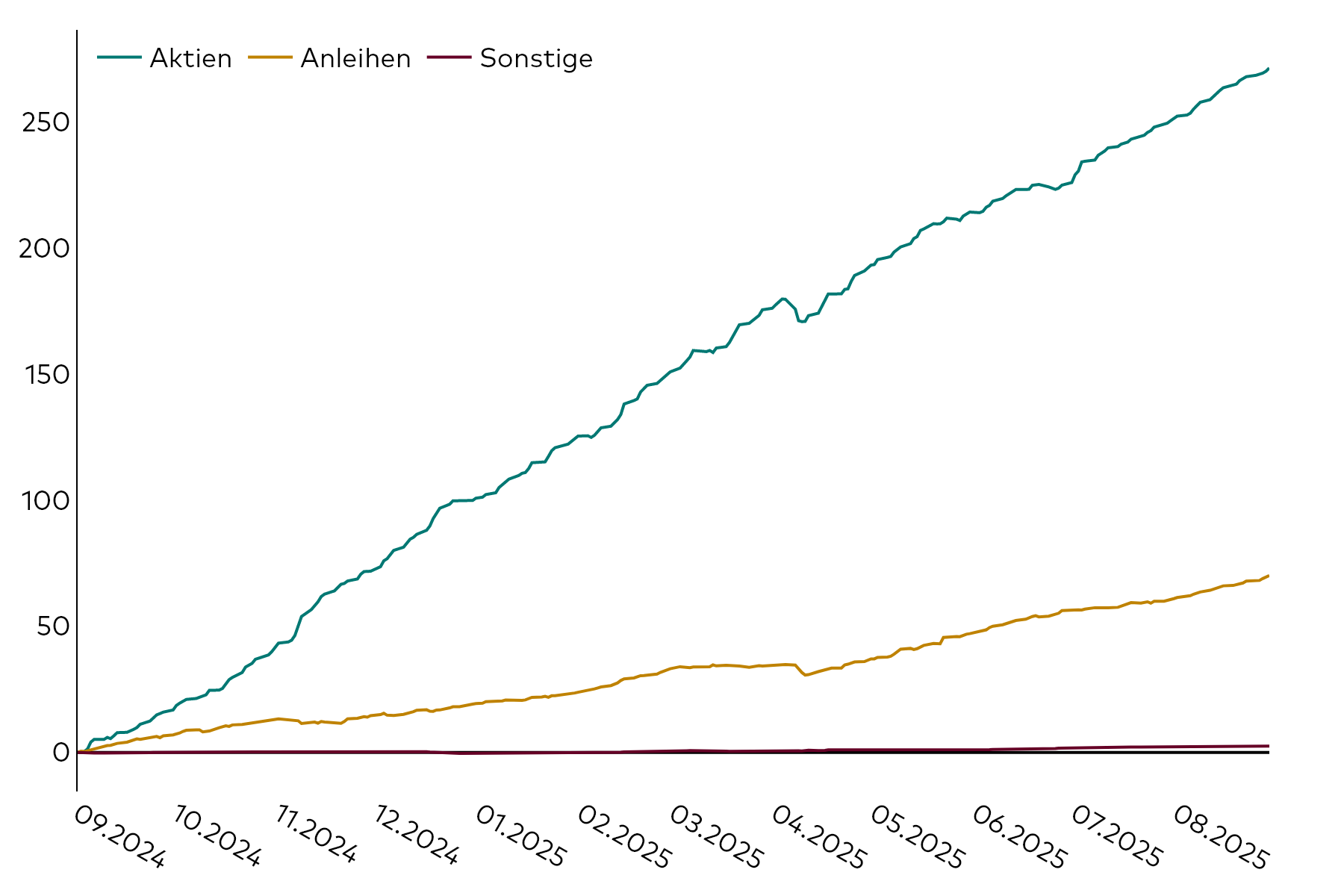

Vor diesem Hintergrund investierten Anlegerinnen und Anleger so viel Kapital in ETFs wie nie zuvor: Kapitalzuflüsse in europäische ETFs erreichten 2025 ein Rekordniveau von 371,7 Milliarden US-Dollar, womit der im Vorjahr aufgestellte Rekord um beinahe 94 Milliarden US-Dollar übertroffen wurde. 279,0 Milliarden US-Dollar der Mittelzuflüsse entfielen 2025 auf Aktien-ETFs und 88,4 Milliarden US-Dollar auf Anleihen-ETFs.

Die Dezember-Nachfrage nach europäischen ETFs untermauerte die Trends, die bereits das ganze Jahr über sichtbar gewesen waren. Die Kapitalzuflüsse in Core-Aktien-ETFs beliefen sich im letzten Monat des Jahres auf 14,0 Milliarden US-Dollar und lagen damit den zwölften Monat in Folge im positiven Bereich. Auf das Gesamtjahr gesehen wurde ein Volumen von 182,4 Milliarden US-Dollar in dieses Segment investiert. Auch ETFs auf globale Aktien und Industrieländer-Aktien verzeichneten in allen Monaten des Jahres 2025 Kapitalzuflüsse (Gesamtvolumen 2025: 65,2 Milliarden US-Dollar bzw. 46,0 Milliarden US-Dollar), während US-Aktien-ETFs das Jahr trotz Nettoabflüssen in fünf einzelnen Monaten insgesamt mit Nettozuflüssen von 39,2 Milliarden US-Dollar beendeten.

Bei Anleihen-ETFs bevorzugten Anlegerinnen und Anleger nicht nur im Dezember, sondern über das gesamte Jahr hinweg Strategien für den Euroraum. Nach 12 aufeinanderfolgenden Monaten mit Nettozuflüssen belief sich das Investitionsvolumen in dieser Kategorie auf 46,6 Milliarden US-Dollar. Auch ETFs auf Anleihen mit sehr kurzer Laufzeit generierten von Januar bis Dezember 2025 Nettozuflüsse und insgesamt ein Volumen von 31,7 Milliarden US-Dollar – und zum Abschluss im Dezember mit 3,4 Milliarden US-Dollar den zweithöchsten monatlichen Kapitalzufluss des Jahres. Währenddessen hielten sich die Kapitalzuflüsse in ETFs auf Staats- und Unternehmensanleihen mit jeweils 20,8 Milliarden US-Dollar bzw. 20,7 Milliarden US-Dollar beinahe die Waage.

Zu guter Letzt profitierten Multi-Asset- und Rohstoff-ETFs im Dezember von Nettozuflüssen, während ETFs auf alternative Assetklassen Nettoabflüsse verzeichnen mussten. Alle drei Kategorien beendeten das Jahr aber im positiven Bereich.

Übersicht

Weiterhin solide ETF-Kapitalzuflüsse im Dezember

Kumulative Kapitalflüsse europäischer ETFs der letzten 12 Monate nach Assetklasse (Mrd. USD)

Quelle: ETFbook; Stand: 31. Dezember 2025.

Aktien-ETFs

Jahresendspurt bei Core-Aktien-ETFs

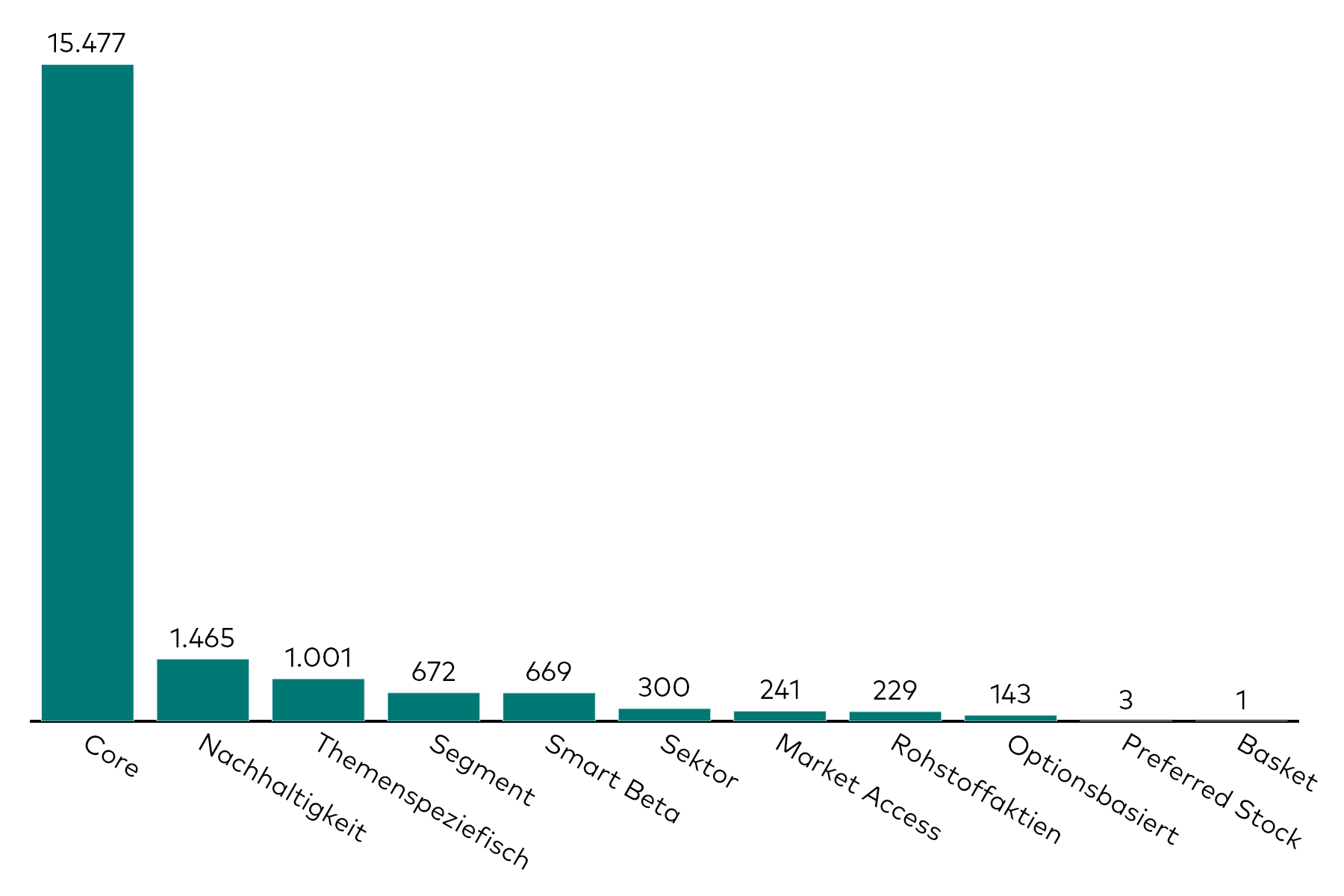

Kapitalflüsse nach Segment: Laufender Monat (Mio. USD)

Quelle: ETFbook; Stand: 31. Dezember 2025. Zur „Segment“-Kategorie gehören Aktien-ETFs auf bestimmte Marktkapitalisierungssegmente wie Small Cap, Mid Cap und Large Cap. „Market Access“-ETFs investieren in schwer zugängliche Märkte wie Schwellenländer. Die „Basket“-Kategorie umfasst Strategien, die mehrere Aktien als Basiswerte kombinieren.

Core-Aktien-ETFs verzeichneten weiterhin eine hohe Nachfrage. Inklusive der Nettozuflüsse von 14,0 Milliarden US-Dollar im Dezember beliefen sich die Nettozuflüsse 2025 auf insgesamt 182,4 Milliarden US-Dollar. Auch Smart-Beta-Aktien-ETFs und Sektor-ETFs erzielten im letzten Monat des Jahres Nettozuflüsse von 4,3 Milliarden US-Dollar bzw. 2,2 Milliarden US-Dollar, während Segment-ETFs geringe Nettoabflüsse von 93 Millionen US-Dollar hinnehmen mussten.

Dominanz von ETFs auf Industrieländeraktien hält an

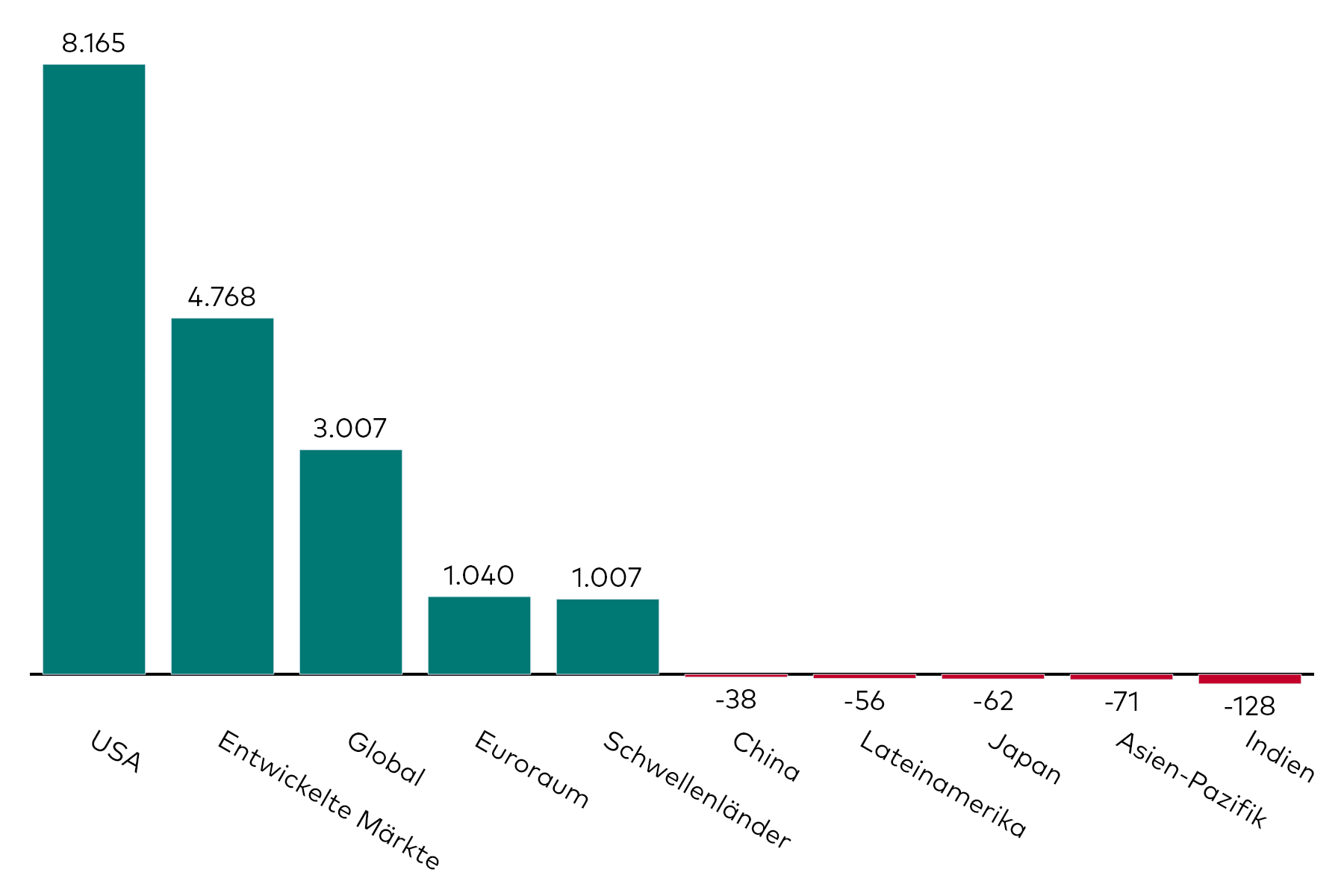

Nettoneuvermögen von Aktien-ETFs nach Region: Laufender Monat (Mio. USD)

Quelle: ETFbook; Stand: 31. Dezember 2025.

Mit Nettozuflüssen von 7,9 Milliarden US-Dollar fuhren ETFs auf Industrieländeraktien im Dezember 2025 ihr zweitbestes Ergebnis im abgelaufenen Jahr ein und lagen damit erneut vor den anderen Kategorien. Die über alle Monate hinweg durchweg positiven Mittelflüsse resultierten auf das Gesamtjahr gesehen in einem Nettoneuvermögen von 65,2 Milliarden US-Dollar. ETFs auf globale Aktien wiesen ebenfalls über alle Monate hinweg positive Mittelflüsse aus und beendeten das Jahr nach einem Monatsergebnis von 3,7 Milliarden US-Dollar im Dezember mit einem Nettoneuvermögen von 46,0 Milliarden US-Dollar. ETFs auf Industrieländeraktien ohne die USA sowie ETFs auf deutsche Aktien mussten im Dezember hingegen Nettoabflüsse von 967 Millionen US-Dollar bzw. 415 Millionen US-Dollar hinnehmen.

Anleihe-ETFs

Erneut positive Kapitalflüsse bei ETFs auf Anleihen mit sehr kurzer Laufzeit

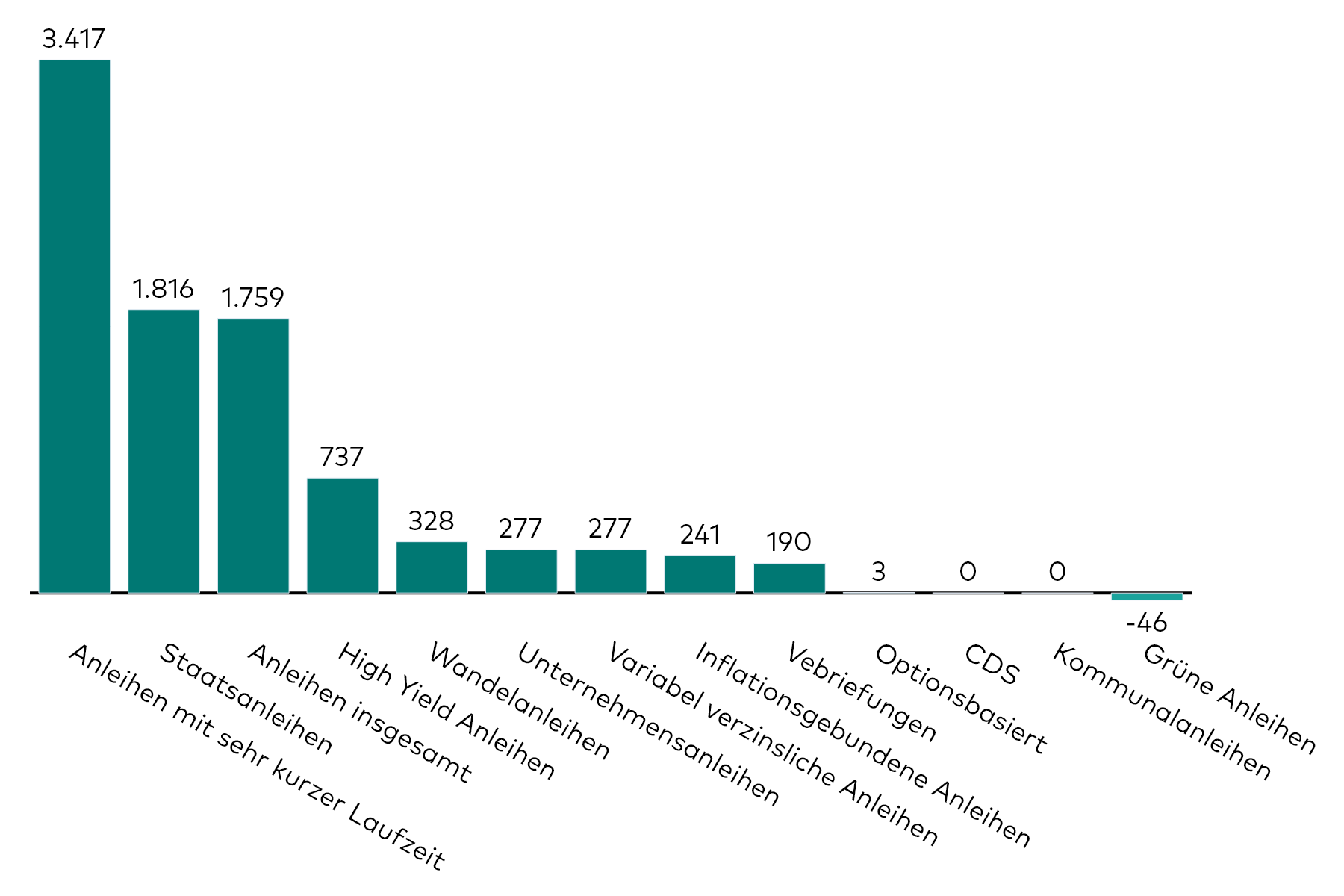

Nettoneuvermögen von Anleihen-ETFs nach Kategorie: Laufender Monat (Mio. USD)

Quelle: ETFbook; Stand: 31. Dezember 2025.

ETFs auf Anleihen mit sehr kurzer Laufzeit verzeichneten im Dezember 2025 Nettozuflüsse von 3,4 Milliarden US-Dollar, während in Staatsanleihen-ETFs und Aggregate-Bonds-ETFs jeweils 1,8 Milliarden US-Dollar investiert wurden. Dabei waren die Kapitalflüsse in ETFs auf Anleihen mit sehr kurzer Laufzeit in jedem Monat positiv und summierten sich im Gesamtjahr auf 31,7 Milliarden US-Dollar. ETFs auf grüne Anleihen beendeten das Jahr im Dezember mit moderaten Nettoabflüssen von 46 Millionen US-Dollar.

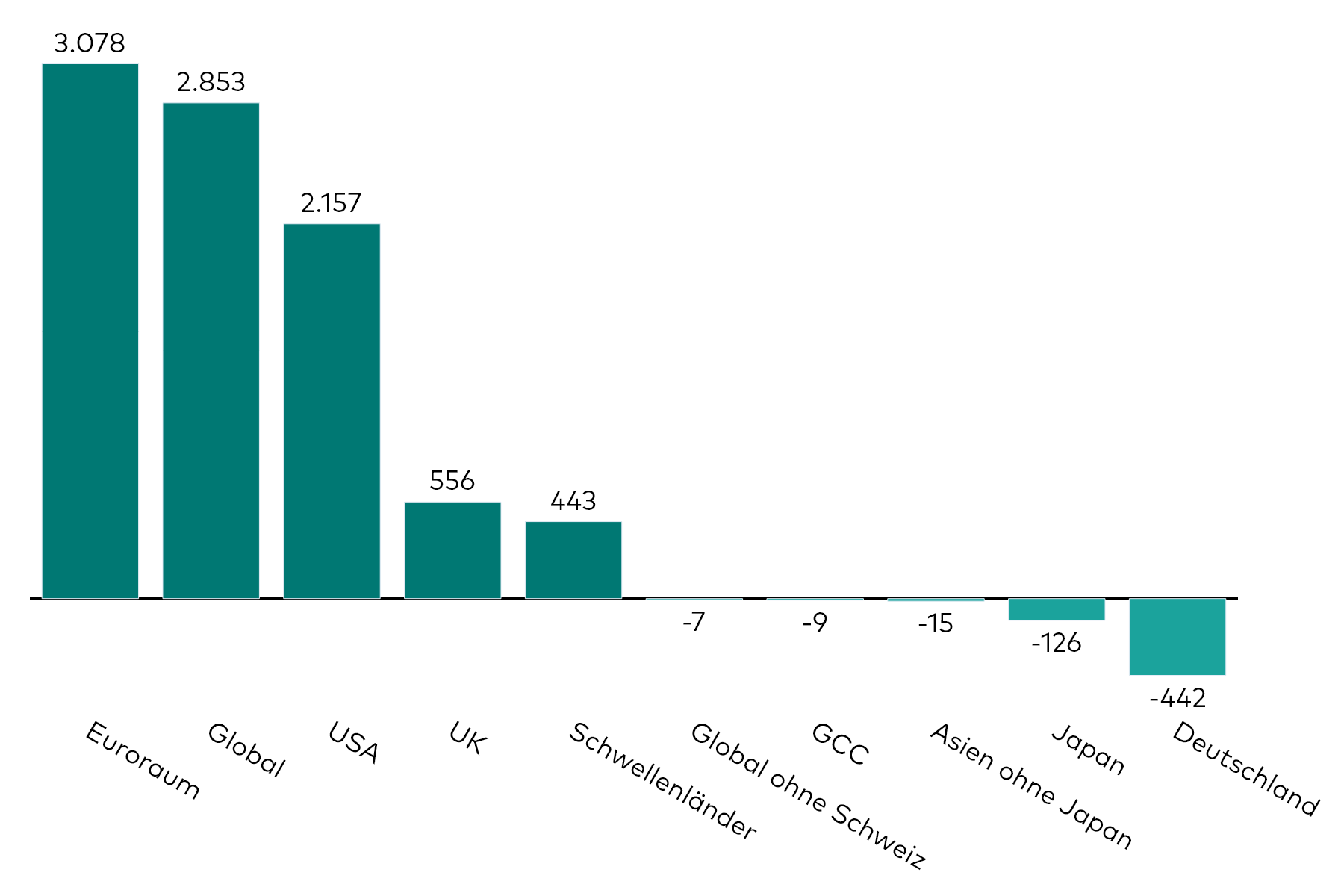

ETFs auf Euroraum-Anleihen knapp über ETFs auf globale Anleihen

Nettoneuvermögen von Anleihen-ETFs nach Region: Laufender Monat (Mio. USD)

Quelle: ETFbook; Stand: 31. Dezember 2025.

ETFs auf Euroraum-Anleihen verzeichneten unter den Fixed-Income-Produkten erneut die höchste Nachfrage. Die hier im Dezember generierten Nettozuflüsse von 3,1 Milliarden US-Dollar übertrafen knapp die Nettozuflüsse des globalen Segments von 2,9 Milliarden US-Dollar. Damit wiesen ETFs auf Euroraum-Anleihen nach 12 Monaten positiver Kapitalflüsse 2025 ein Nettoneuvermögen von 46,6 Milliarden US-Dollar aus. Auch ETFs auf US-Anleihen verzeichneten im Dezember positive Mittelflüsse von 2,2 Milliarden US-Dollar, während ETFs auf deutsche und japanische Anleihen das Jahr mit Nettoabflüssen in Höhe von 442 Millionen US-Dollar bzw. 126 Millionen US-Dollar beendeten.

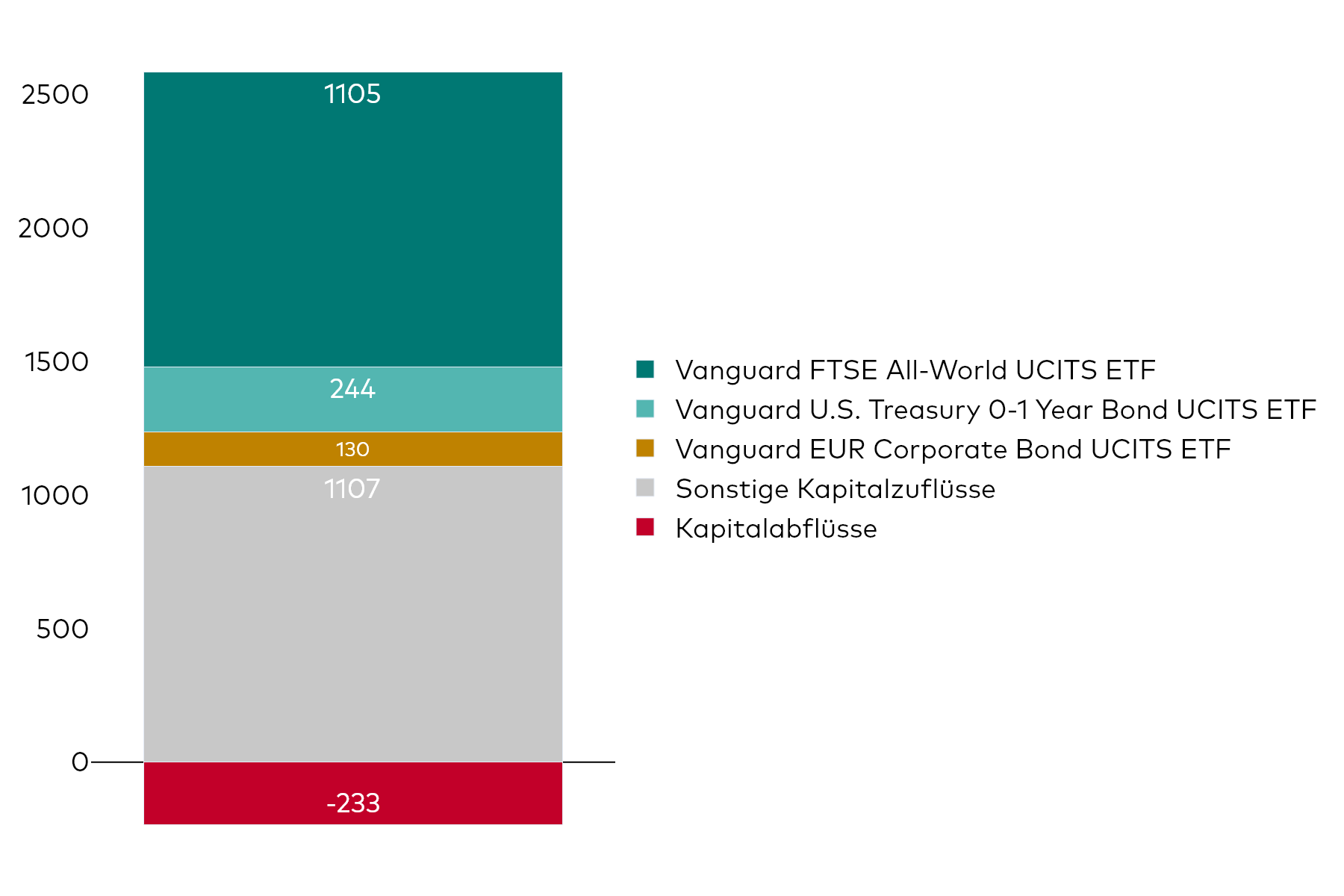

Vanguard UCITS ETFs

Vanguard ETFs im Dezember mit Mittelzuflüssen von 2,8 Milliarden US-Dollar

Nettoneuvermögen von Vanguard UCITS ETFs: Laufender Monat (Mio. USD)

Quelle: ETFbook; Stand: 31. Dezember 2025.

Vanguard UCTIS ETFs beendeten den Monat Dezember überwiegend mit Zuflüssen und wiesen ein Nettoneuvermögen von insgesamt 2,8 Milliarden US-Dollar aus. Dabei entfielen 2,5 Milliarden US-Dollar auf Vanguard Aktien-UCITS-ETFs, 220 Millionen US-Dollar auf Anleihen-UCITS-ETFs, 40 Millionen US-Dollar auf Multi-Asset-UCITS-ETFs und 31 Millionen US-Dollar auf Euro-Cash-ETFs.

Relevante ETFs

Werden Sie zum Anlagespezialisten und sammeln Sie CPD-Punkte

Von wichtigen Anlageprinzipien bis zum Portfolioaufbau – mit unseren Multimedia-Anwendungen können Sie Ihr Anlagewissen vertiefen.

Events und Webinare

Live oder On-Demand – spannende Events für Sie, von Marktthemen bis zu Portfolio- und Verhaltenscoaching.

Wichtige Hinweise zu Anlagerisiken

Der Wert der Investitionen und die daraus resultierenden Erträge können steigen oder fallen, und Investoren können Verluste auf ihrer Investitionen erleiden.

Die frühere Wertentwicklung gibt keinen verlässlichen Hinweis auf zukünftige Ergebnisse. In den Performanceangaben sind die Provisionen und Kosten im Zusammenhang mit der Ausgabe und Rücknahme von Anteilen nicht berücksichtigt.

Die dargestellten Performance-Kennzahlen können in einer Währung berechnet werden, die von der Währung der Anteilsklasse abweicht, in die Sie investiert sind. Infolgedessen können die Renditen aufgrund von Währungsschwankungen sinken oder steigen.

Bei Investitionen in kleinere Unternehmen kann eine höhere Volatilität gegeben sein, als dies bei Investitionen in etablierte und solide (auch sog. Blue-Chip-Unternehmen) der Fall ist.

ETF-Anteile können nur durch einen Makler erworben oder verkauft werden. Die Anlage in ETFs bringt eine Börsenmakler-Provision und eine Geld-Brief-Spanne mit sich, was vor der Anlage vollständig berücksichtigt werden sollte.

Der Fonds kann derivative Finanzinstrumente verwenden, um Risiken oder Kosten zu reduzieren und/oder zusätzliche Erträge oder Wachstum zu generieren. Die Verwendung von derivativen Finanzinstrumenten kann eine Erhöhung oder Verringerung des Engagements in Basiswerten bewirken und zu stärkeren Schwankungen des Nettoinventarwerts des Fonds führen. Derivative Finanzinstrumente sind finanzielle Kontrakte, deren Wert auf dem Wert einer Finanzanlage (wie zum Beispiel Aktien, Anleihen oder Währungen) oder einem Marktindex basiert.

Einige Fonds investieren in Wertpapiere, die auf unterschiedliche Währungen lauten. Der Wert dieser Anlagen kann aufgrund von Wechselkursschwankungen steigen oder fallen.

Weitere Informationen zu Risiken finden Sie im Abschnitt „Risikofaktoren“ im Verkaufsprospekt auf unserer Webseite.

Wichtige allgemeine Hinweise

Dies ist eine Marketingmitteilung.

Nur für professionelle Anleger (nach den Kriterien der MiFID II-Richtlinie), die auf eigene Rechnung investieren (einschließlich Verwaltungsgesellschaften (Dachfonds) und professionelle Kunden, die im Namen ihrer diskretionären Kunden investieren). In der Schweiz nur für professionelle Anleger. Nicht für die öffentliche Verbreitung bestimmt.

Die hier enthaltenen Informationen sind nicht als Angebot oder Aufforderung zur Abgabe eines Angebots zum Kauf oder Verkauf von Wertpapieren in irgendeiner Gerichtsbarkeit zu verstehen, in der ein solches Angebot oder eine solche Aufforderung rechtswidrig ist, oder gegenüber Personen, gegenüber denen ein solches Angebot oder eine solche Aufforderung gesetzlich nicht gemacht werden darf, oder wenn derjenige, der das Angebot oder die Aufforderung macht, dafür nicht qualifiziert ist. Die Informationen sind allgemeiner Natur und stellen keine Rechts-, Steuer- oder Anlageberatung dar. Potenzielle Anleger werden ausdrücklich aufgefordert, ihre professionellen Berater zu konsultieren und sich über die Konsequenzen einer Anlage, des Haltens und der Veräußerung von [Anteilen/Aktien] sowie des Erhalts von Ausschüttungen aus Anlagen zu informieren.

Für Schweizer professionelle Anleger: Potenzielle Anlegerinnen und Anleger profitieren bei der Beurteilung der Angemessenheit und Eignung nicht vom Schutz des FinSA.

Vanguard Funds plc wurde von der irischen Zentralbank als OGAW zugelassen und für den öffentlichen Vertrieb in bestimmten EWR-Ländern und in Großbritannien registriert. Künftige Anleger finden im Prospekt des Fonds weitere Informationen. Künftigen Anlegern wird außerdem dringend geraten, sich bezüglich der Auswirkungen einer Anlage in den Fonds, dem Halten oder der Veräußerung von Anteilen des Fonds und dem Erhalt von Ausschüttungen aus solchen Anteilen im Rahmen der Gesetze, in dem sie steuerpflichtig sind, an ihren persönlichen Berater zu wenden.

Der Manager von Vanguard Funds plc ist Vanguard Group (Ireland) Limited. Vanguard Asset Management, Limited ist eine Vertriebsgesellschaft von Vanguard Funds plc.

Für Schweizer professionelle Anleger: Der Manager von Vanguard Funds plc ist Vanguard Group (Ireland) Limited. Die Vanguard Investments Switzerland GmbH ist eine Vertriebsgesellschaft von Vanguard Funds plc in der Schweiz. Vanguard Funds plc wurde von der Zentralbank von Irland als OGAW zugelassen. Künftige Anleger finden im Prospekt des Fonds weitere Informationen. Künftigen Anlegern wird außerdem dringend geraten, sich bezüglich der Auswirkungen einer Anlage in den Fonds, dem Halten oder der Veräußerung von Anteilen des Fonds und dem Erhalt von Ausschüttungen aus solchen Anteilen im Rahmen der Gesetze, in dem sie steuerpflichtig sind, an ihren persönlichen Berater zu wenden.

Für Schweizer professionelle Anleger: Vanguard Funds plc wurde von der Eidgenössischen Finanzmarktaufsicht FINMA zum Vertrieb in und aus der Schweiz zugelassen. Die Vertretung und Zahlstelle in der Schweiz ist BNP Paribas Securities Services, Paris, Succursale de Zurich, Selnaustrasse 16, 8002 Zürich. Exemplare der Satzung, des KIID und des Verkaufsprospekts für diese Fonds sind kostenlos in Landessprachen bei der Vanguard Investments Switzerland GmbH über unsere Website und bei der Vertretung in der Schweiz erhältlich.

Die Verwaltungsgesellschaft der in Irland domizilierten Fonds kann beschließen, alle Vereinbarungen über den Vertrieb der Anteile in einem oder mehreren Ländern gemäß der OGAW-Richtlinie in ihrer jeweils gültigen Fassung zu beenden.

Der indikative Nettoinventarwert („iNIW“) für die ETFs von Vanguard wird auf Bloomberg oder Reuters veröffentlicht. Informationen zu den Beständen finden Sie in der Portfolio Holdings Policy.

Für Anleger in Fonds mit Sitz in Irland ist eine Zusammenfassung der Anlegerrechte in den Sprachen Englisch, Deutsch, Französisch, Spanisch, Niederländisch und Italienisch erhältlich.

Zu den Unternehmen der London Stock Exchange Group gehören FTSE International Limited ("FTSE"), Frank Russell Company ("Russell"), MTS Next Limited ("MTS“) und FTSE TMX Global Debt Capital Markets Inc. ("FTSE TMX"). Alle Rechte vorbehalten. "FTSE®", "Russell®", "MTS®", "FTSE TMX®" und "FTSE Russell" sowie andere Dienstleistungs- und Handelsmarken im Zusammenhang mit den Indizes von FTSE oder Russell sind Handelsmarken der Unternehmen der London Stock Exchange Group und werden von FTSE, MTS, FTSE TMX und Russell unter Lizenz verwendet. Alle Informationen werden nur zu Informationszwecken aufgeführt. Die Unternehmen der London Stock Exchange Group und die Lizenzgeber übernehmen keine Verantwortung und keine Haftung für Fehler oder Verluste, die durch die Verwendung dieser Publikation entstehen. Die Unternehmen der London Stock Exchange Group und die Lizenzgeber enthalten sich jeder impliziten oder expliziten Behauptung, Vorhersage, Gewährleistung oder Stellungnahme sowohl in Bezug auf die Ergebnisse, die durch die Nutzung der FTSE oder Russell Indizes erzielt werden können, als auch die Tauglichkeit oder Eignung der Indizes für jedweden Zweck, zu dem sie herangezogen werden könnten.

Der S&P 500 Net Total Return Index und der S&P 500 Index sind Produkte der S&P Dow Jones Indices LLC (“SPDJI”). Vanguard hat eine Nutzungslizenz für beide Indizes. Standard & Poor’s® und S&P® sind eingetragene Handelsmarken von Standard & Poor‘s Financial Services LLC (“S&P”); Dow Jones® ist eine eingetragene Handelsmarke der Dow Jones Trademark Holdings LLC (“Dow Jones”); S&P® und S&P 500® sind Handelsmarken von S&P; SPDJI hat eine Nutzungslizenz dieser Handelsmarken, Vanguard hat für bestimmte Zwecke eine Sublizenz. Der Vanguard US Equity Index Fund, Vanguard US 500 Stock Index Fund, Vanguard S&P 500 UCITS ETF und der Vanguard US Equity Common Contractual Fund werden durch SPDJI, Dow Jones, S&P oder deren jeweilige Tochtergesellschaften nicht gesponsert, gefördert, verkauft oder unterstützt. Keine dieser Parteien gibt eine Gewähr für die Anlagetauglichkeit solcher Produkte oder haftet in irgendeiner Form für Fehler, Auslassungen oder Unterbrechungen des S&P 500 Net Total Return Index und des S&P 500 Index.

Nur für niederländische Investoren: Der oder die hier erwähnte(n) Fonds ist/sind im AFM-Register gemäß der Definition in Abschnitt 1:107 des niederländischen Gesetzes über die Finanzaufsicht (Wet op het financieel toezicht) aufgeführt. Einzelheiten zum Risikoindikator für jeden aufgeführten Fonds entnehmen Sie bitte dem jeweiligen Factsheet, das Sie auf unserer Webseite finden.

Im EWR herausgegeben von der Vanguard Group (Ireland) Limited, die in Irland von der irischen Zentralbank reguliert wird.

In der Schweiz herausgegeben von Vanguard Investments Switzerland GmbH.

Herausgegeben von Vanguard Asset Management, Limited, die in Großbritannien von der Financial Conduct Authority zugelassen ist und von ihr reguliert wird.

© 2026 Vanguard Group (Irland) Limited. Alle Rechte vorbehalten.

© 2026 Vanguard Investments Switzerland GmbH. Alle Rechte vorbehalten.

© 2026 Vanguard Asset Management, Limited. Alle Rechte vorbehalten.